Key points

- Many uninsured Americans are unaware of the open enrollment period for health insurance.

- If open enrollment is missed, there are still options such as special enrollment periods, government programs, and short-term medical policies.

- Some states have their own individual health insurance mandate, penalizing those without insurance.

- Urgent care centers can provide affordable treatment for uninsured patients.

- Despite the removal of a federal tax penalty for being uninsured, certain states have implemented their own penalties. It is also important to note that emergency rooms are required to treat anyone, regardless of their ability to pay, but urgent care centers can be a more cost-effective option for uninsured patients.

The healthcare open enrollment period has gotten shorter

Originally, the open enrollment period spanned six months. Now, Americans only have a month and a half, November 1 to December 15, to enroll in health insurance each year through the Health Insurance Marketplace. If you get health insurance from your job, your open enrollment period may be different, but your human resources department will be able to let you know when it is.

Open enrollment can seem like a hassle but, without it, most people would only buy health insurance when they knew they were about to face high medical bills (this is called adverse selection, and it can hurt an insurance company’s ability to pay for your medical expenses). By making the open enrollment window shorter, the Marketplace hopes to incentivize more healthy people in the US to sign up for a full year of insurance, instead of relying on short-term plans (or no plans at all) until they need medical care.

You may qualify for a special enrollment period

If you missed the open enrollment deadline, there’s still a chance that you could enroll in health coverage during what’s known as a ‘special enrollment period’. If you’ve had a qualifying life change in the past 60 days (think: having a baby, getting married, moving, or losing your old insurance coverage), you can use a special enrollment period to get health insurance for 2020.

Worried about how you’ll pay for your insurance each month? If you have a lower income, you may be able to enroll in free or low-cost health insurance from the government through Medicaid or the Children’s Health Insurance Program (CHIP). Another plus side of these programs is that enroll whenever you need to, not just during open enrollment. HealthCare.gov even has an online quiz that can help you figure out if you qualify for Medicaid or CHIP.

Short-term medical insurance policies are available year-round

Now, if you don’t qualify for a special enrollment period, Medicaid, or CHIP, it may be time to start checking out short-term medical (STM) policies. You can get an STM policy any time, and they usually cover you for three to six months. These plans are better than not having insurance at all but they probably won’t give you the same level of coverage as a typical yearlong plan would.

Also, unlike traditional health insurance plans, STM plans can refuse to cover pre-existing conditions, which doesn’t exactly help if you’re looking for insurance to help you manage a chronic illness or to find cheaper treatment for an injury. They also may not cover some basic healthcare essentials, like prescription drugs, mental health care, or maternity care. If you live in a state with Minimum Essential Coverage requirements (more on this in a sec), a STM policy may not save you from getting penalized on your state taxes.

Some people can still get penalized for being uninsured

We’ve talked about how the Affordable Care Act made it easier for uninsured Americans to shop for healthcare plans that fit their budgets, and we mentioned the tax penalty that came with it. This penalty, called an individual health insurance mandate, meant additional tax-season fees for anyone that went without health insurance for three or more months. However, The Tax Cuts and Jobs Act in 2017 got rid of that penalty, starting on January 1, 2019.

After the government did away with individual mandate, some states created their own to encourage residents to continue paying for health insurance coverage. (Massachusetts was ahead of the curve and made theirs back in 2006). If you live in California, Washington D.C., Massachusetts, New Jersey, Rhode Island, or Vermont and you’re uninsured, you could see an extra fee when you file your state taxes. The cost you’ll pay for going without insurance depends on where you live, but it’s typically something similar to the initial penalty created by the ACA—$695 per adult and $347.50 per child, or 2.5% of your household income, whichever is higher.

What if you need care while you’re uninsured?

Thanks to the Emergency Medical Treatment & Labor Act (EMTALA), passed over 30 years ago, the ER cannot turn you away if you can’t pay for your care. They have to treat anyone that works through their doors, no matter what. But that doesn’t mean that going to the ER is your only (or even your best) option.

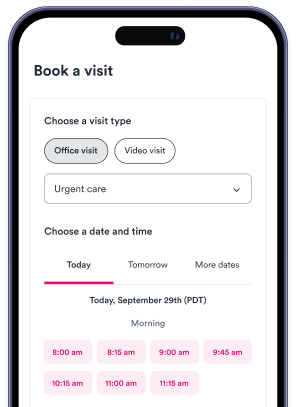

Urgent care centers are experts at treating uninsured patients, and you can go there for most of the things that would normally have you waiting for hours for care at the ER (except for much, much cheaper). Unlike most hospitals, many urgent cares post their prices online (and we list all of our providers’ cash-pay prices on their Solv profile), so you know exactly what you’ll be expected to pay before you go. Plus, if you tell your urgent care center that you’re paying for your visit out of pocket, they may offer discounts or payment plans.

Download the Solv app and start knowing what’s covered, and what you’ll have to pay out of pocket — before your appointment.

When was the open enrollment deadline for 2020 coverage?

Open enrollment deadlines vary depending on where you’re buying your coverage. If you’re getting health insurance from your job, your human resources department should be able to let you know when your open enrollment takes place each year. Generally, most companies have open enrollment sometime in the fall. If you’re getting your health insurance through a federal program, the open enrollment dates were:

- HealthCare.gov and state marketplaces: November 1 to December 15, though some states had extended deadlines because they operate their own marketplaces

- Medicare: October 15 to December 7

- Medicaid and CHIP: You can apply at any time

Who qualifies for a special enrollment period?

You should be eligible for a special enrollment period if you or someone in your household:

- Got married

- Had a baby

- Adopted a child

- Placed a child for foster care

- Got divorced or legally separated and lost health insurance

- Died

You may also be eligible for a special enrollment period if:

- You moved to a different zip code or county

- You lost your health insurance

- Your employer offered to help pay for health insurance costs

- You just left incarceration

- You just became a U.S. citizen

The special enrollment period typically lasts 60 days after your life event, and you will need to show documentation that it happened before you can enroll in a health insurance plan or make changes to your current plan.

How can I get insurance after open enrollment?

The best place to buy your health insurance depends on:

- Where you live

- Whether you’re eligible for a special enrollment period

- If you qualify for tax credits that lower your monthly payments

HealthCare.gov and state insurance marketplaces are the only places that offer plans with tax credits, so they’ll be your best bet if you qualify for reduced monthly payments. If your state has its own marketplace, you’ll go through them. If not, you’ll go through HealthCare.gov. However, you can only buy plans from these places during open enrollment or a special enrollment period. Confusing, right? That’s why we’re here.

If you know you don’t qualify for tax credits on your health insurance, then you can also get plans from insurance agents, brokers, and directly from health insurance companies. Unlike federal and state marketplaces, these providers can also offer short-term plans for people who don’t qualify for special enrollment.

Insurance agents typically work for a single insurance company, just like a car or home insurance agent. Brokers, on the other hand, can help you explore plans from different insurance companies to see which is the best fit for you and your family. Online insurance brokers can offer a shop-and-compare experience that’s similar to what you’d find on HealthCare.gov.

No matter where you buy your health insurance, you should take the time to learn what your plan covers—and what it doesn’t—so you aren’t surprised by unexpected medical bills. Health insurance seems confusing and that’s because it is. Solv makes it simple—our free app tracks your progress toward your deductible and unlocks hidden insurance benefits. Win! Download now.

FAQs

What is the open enrollment period for health insurance?

The open enrollment period is a specific time frame during which individuals can enroll in health insurance. The dates can vary depending on the source of the coverage.

What are my options if I missed the open enrollment period?

You might qualify for a special enrollment period, be eligible for Medicaid or CHIP, or consider short-term medical insurance policies.

What is a special enrollment period?

A special enrollment period is a time outside of the open enrollment period during which you can sign up for health insurance if you've had a qualifying life event.

What are the penalties for not having health insurance?

While there is no longer a federal penalty, some states have their own individual health insurance mandates that can result in a penalty.

What happens if I need medical care but don't have insurance?

Emergency rooms are required to treat anyone regardless of their ability to pay. Urgent care centers also often provide affordable care for uninsured patients.

What is the cost of not having health insurance?

Without insurance, you would be responsible for all of your medical costs. A single doctor's visit can cost close to $200, and hospitals can charge up to $10,000 a night for overnight stays. An unexpected medical bill of just $400 could put 40% of Americans into debt.

What if I need medical care while I'm uninsured?

If you need medical care while you're uninsured, you won't be turned away from the emergency room due to the Emergency Medical Treatment & Labor Act (EMTALA). However, urgent care centers are often a more affordable option for uninsured patients.

How can I get insurance after the open enrollment period has ended?

If you've had a qualifying life event, you may be eligible for a special enrollment period. If not, you may be able to get a short-term medical policy. Additionally, if you have a lower income, you may be able to enroll in free or low-cost health insurance from the government through Medicaid or the Children’s Health Insurance Program (CHIP) at any time.