Key points

- Without insurance, annual physicals typically cost between $50-$300, with an average cost of $199 in the U.S.

- The cost of a physical exam can vary based on location, healthcare provider, and any additional tests or treatments required.

- An annual physical is a wellness exam to evaluate overall health, identify risk factors, detect early-stage diseases, and discuss lifestyle habits.

- Additional costs may be incurred for lab tests, screenings, or diagnostic tools like x-rays during the physical exam.

If you are in need of an annual physical, you may be wondering how much annual physicals cost without insurance. Without insurance, you can typically expect to pay anywhere between $50–$300 for a physical exam. The average cost for an annual physical in the U.S. without insurance is $199, according to the Agency for Healthcare Research and Quality. The exact cost will depend on several factors, such as where you have your physical done, who conducts the exam, and whether you need any additional tests or treatment.

What is an annual physical?

An annual physical, also known as a wellness exam, is a yearly doctor’s appointment to evaluate your overall health and check for any emerging medical problems before they become severe. Most healthy adults may not require an annual physical, but they are recommended for anyone who has had medical issues in the past or who may be at risk of certain diseases or conditions. They are also sometimes required for employment or school.

According to the Agency for Healthcare Research, an annual physical allows your health care provider to:

-

Identify any risk factors for common diseases

-

Detect diseases in early stages that may not yet have apparent symptoms

-

Review lifestyle habits and help you develop better habits, such as quitting smoking or exercising more

-

Provide any necessary vaccinations

An annual physical also allows you to be proactive about your health and discuss any health concerns with your doctor before they develop into bigger issues. You may also want to discuss any medications, vitamins, or other health measures you are currently using.

If you are relatively healthy, you can expect the cost of your annual physical to be on the lower end. However, if your doctor finds it necessary to order any tests or use additional diagnostic tools such as x-rays, these will add to the cost of your physical, notes the Agency.

What happens during an annual physical?

According to Solv’s Chief Medical Officer, Dr. Rob Rohatsch, an annual physical usually involves a physical exam that may include the following:

-

Vital signs: Your doctor will take important vital signs such as blood pressure, heart rate, and blood oxygen saturation

-

General appearance: Your doctor will look at your skin, posture, and other attributes to check for any new symptoms

-

Mental acuity: Your doctor may have you perform some simple tests to evaluate memory and cognition

-

A full physical examination of your body. This includes a full neurologic exam. Special attention is given to the cardiac exam

Men may also undergo a hernia exam or a prostate exam during their annual physical. Women may also have a breast exam and pelvic exam included in their wellness exam.

Following your physician exam, your doctor may want to order some additional tests. These may include blood work or x-rays. Blood work is often used to check organ function, electrolytes, blood sugar levels, cholesterol, and thyroid levels. In many cases, your doctor’s office will take a blood sample and send it to a lab for analysis. If this is the case, you can expect to receive a separate bill for the lab work.

An annual physical may be performed by a physician, a nurse practitioner, or a physician’s assistant.

Where can you get an annual physical?

Ideally, an annual physical should be performed by your primary care physician (PCP), according to Dr. Rohatsch. If you don’t have a primary care physician, it’s a good idea to find one. This will allow you to establish an ongoing relationship with someone aware of your medical history and can help monitor your health over time.

If necessary, you can also get an annual physical at an urgent care center.

Breakdown of annual physical costs without insurance

The cost of an annual physical exam can vary significantly based on several factors, including geographic location and the specific healthcare provider. In urban areas, for example, prices may be higher due to increased demand and higher operational costs for medical facilities. Conversely, rural areas might offer more competitive pricing, although access to specialized providers could be limited. Additionally, the type of healthcare provider—whether it’s a primary care physician, a community health clinic, or a specialist—can also influence the overall cost of the exam. On average, patients can expect to pay anywhere from $100 to $300 for a basic physical exam without insurance, but this figure can fluctuate based on the aforementioned factors.

In addition to the base cost of the physical exam itself, patients should be prepared for potential additional expenses related to laboratory tests and screenings that may be recommended during the visit. Common additional costs can include routine blood tests, tuberculosis (TB) tests, Pap smears, and electrocardiograms (EKGs). Each of these tests can add anywhere from $50 to several hundred dollars to the total bill, depending on the facility and the specific tests ordered. It is essential for patients to inquire about the costs of these additional services beforehand to avoid unexpected expenses and to consider discussing payment options or sliding scale fees with their healthcare provider.

Paying self-pay prices for annual physicals

Most health insurance plans cover the full cost of an annual physical exam, however, additional services added onto the exam such as certain lab tests, may not be. Even if you have insurance, you may be able to save money by paying cash for these additional tests and services. Additionally, other types of physicians, including school, sports and camp physicals, are always self-pay services as they are not covered by health insurance.

It’s always a good idea to check with your insurance company ahead of time to determine whether a physical and other related services are covered under preventive care. In some cases, the exam itself may be covered, but additional tests or lab work may be applied to your deductible.

If you have a high-deductible plan and you don’t anticipate meeting your deductible for the calendar year, it may be cheaper to pay your provider directly. When billing insurance companies, medical providers often charge a higher rate. However, when billing patients directly, they are more likely to consider what patients can afford to pay out of pocket and charge accordingly. This price is known as the self-pay price and is often significantly lower than the price charged to insurance companies.

It’s always a good idea to ask about self-pay prices before your medical appointment. Based on Solv’s internal research, many medical providers will offer a lower rate to patients paying cash, but may not advertise it. If they are unable or reluctant to give you this information, be persistent. You are entitled to this information, whether or not you have insurance.

If you are paying cash for medical services, you also have a wider range of options, as you are not limited to providers in your insurance network. Take the time to find someone willing to be transparent about medical costs and with whom you feel comfortable.

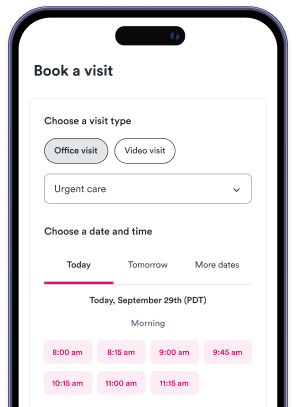

Know what you’ll pay ahead of time with Solv

Solv is committed to transparency in healthcare costs with our ClearPrice™ Pledge. We have partnered with thousands of medical providers across the country who are willing to provide clear medical prices. When you book an appointment through Solv, you will be able to see clear prices for many common services. Knowing what you will pay ahead of time eliminates surprise medical bills, and makes it possible for more people to budget for necessary medical care.

To book an appointment on Solv, search our directory for a provider near you. Simply begin typing a service in the search box, and select from the options that appear. You will be provided with a list of clinics and doctor’s offices near you. In many cases, you can conveniently book an appointment online, and many of our partners offer same-day or next-day appointments.

FAQs

How much does an annual physical cost without insurance?

On average, an annual physical without insurance costs around $199 in the U.S., but the cost can range from $50 to $300 depending on various factors.

What factors influence the cost of an annual physical?

The cost can vary based on the location, the healthcare provider, and any additional tests or treatments that may be required during the exam.

What is the purpose of an annual physical?

An annual physical is a wellness exam to evaluate your overall health, identify any risk factors for common diseases, detect diseases in early stages, and discuss lifestyle habits.

Can additional costs be incurred during an annual physical?

Yes, additional costs may arise for lab tests, screenings, or diagnostic tools like x-rays that may be required during the physical exam.

Is it possible to save money on additional tests and services during an annual physical?

Yes, even if you have insurance, you might save money by paying cash for additional tests and services, as many providers offer a lower self-pay price.