Key points

- Short term disability insurance provides income replacement for individuals unable to work due to a temporary disability, illness, or injury.

- The coverage period for short term disability insurance typically lasts a few months up to a year.

- Short term disability insurance is different from employee-sponsored medical leave or FMLA, which is an unpaid program.

- Short term disability insurance can be beneficial for both employers and employees, providing financial stability during a temporary inability to work.

- The main difference between short term and long term disability insurance is the duration of coverage and the length of time benefits are provided. Other alternatives for taking time off work for a temporary disability include a medical leave of absence, a mental health leave of absence, FMLA leave of absence, long term disability, and Social Security disability.

If you’re unable to work your job due to an illness or injury, you might qualify for short term disability leave, according to Guardian Life. They note that short term disability is a type of insurance that you can use if you are temporarily disabled. Short term disability can help you stay afloat financially until you’re ready to get back to work.

Typically, short term disability covers you for around six months or less (depending on the situation), and can help with some of your lost income and medical bills. Although it won’t cover all your expenses, it can give you enough help to avoid a financial rut with unpaid bills.

Short term disability is not the same as employee-sponsored medical leave, or the Family Medical Leave Act (FMLA), which is a government program that protects your job and health benefits for up to 12 weeks per year, for qualifying employers and employees. Short term disability can sometimes be used in conjunction with FMLA leave, according to ADP, since FMLA is an unpaid program (thus does not provide you with any financial help).

What is short term disability insurance?

Short term disability insurance is a type of insurance coverage that provides income replacement for people who are unable to work due to a temporary disability, illness, or injury, according to ADP.

This type of insurance typically covers a portion of the your income for a limited period of time — the amount of time your insurance covers will vary, based on your coverage, but can be as much as a few months to a year.

The purpose of short term disability insurance is to help you maintain financial stability during a temporary inability to work. This type of insurance is sometimes offered through employers or it can be purchased independently, according to ADP. However you decide to get coverage, it is important to review the specific terms and coverage details of your policy so you understand your specific benefits and limitations.

How does short term disability insurance work?

Short term disability insurance works by providing an income replacement to people who are unable to work due to a temporary disability, illness, or injury, according to Guardian Life.

When you have a short term disability insurance policy, you can file a claim, and upon approval, the insurance company will provide a percentage of your income for the specified benefit period—typically ranging from a few months to a year, depending on the policy terms. During this time, you can focus on recovery and rehabilitation without the added financial stress of lost income and unpaid bills.

When you sign up for a short term disability insurance policy, ADP recommends that you review your policy details for the following disability benefits:

-

How to file a claim and check the status of a claim

-

The waiting period before benefits begin

-

What illnesses, injuries, and disabilities are covered under your policy

-

The percentage of income that your policy will replace

-

The maximum benefit duration (how long your policy will provide income)’

To start a claim for short term disability, you will likely need a doctor’s note to attest to your need to take time off work. You will then need to file a claim with your short term disability insurance provider and file the necessary paperwork with your employer.

What conditions qualify for short term disability?

The specific conditions that qualify for short term disability can vary depending on your disability benefits, according to Guardian Life. However, common qualifying conditions for short term disability may include:

-

Illnesses

-

Injuries

-

Surgeries

-

Complications from pregnancy

-

Recovery from childbirth

-

Other temporary medical conditions that prevent an individual from working, including mental health conditions

According to Limra, the most common reasons for short term disability insurance claims are:

-

Pregnancy complications and recovery

-

Musculoskeletal disorders

-

Injuries

-

Digestive disorders

-

Mental health issues

Benefits of short-term disability insurance

Short term disability can be beneficial for both employers and employees, according to ADP. Employers who offer short term disability are able to

-

Attract new employees who want the peace of mind of short terrm disability benefits

-

Retain valued employees who are able to return to work after a short leave of absence to recover

-

Improve employee financial wellness

For you, the employee, the benefits are equally great, ADP notes that employees who have short term disability can:

-

Recover with the peace of mind that they won’t get behind on unpaid bills

-

Schedule necessary medical procedures knowing that they can take time off and not worry about finances

What’s the difference between short-term and long-term disability insurance?

The main difference between short term and long term disability insurance lies in the duration of coverage and the length of time benefits are provided, according to Guardian Life.

Short term disability insurance typically provides coverage for a limited period of time, often ranging from a few months to a year, although specific durations can vary by policy. On the other hand, long term disability insurance is intended to provide coverage for an extended period.

There are other ways you can take time off work for a temporary disability if you don’t have short term disability insurance. These include:

-

A medical leave of absence

-

A mental health leave of absence

-

FMLA leave of absence

- Long term disability

- Social Security disability (if you qualify)

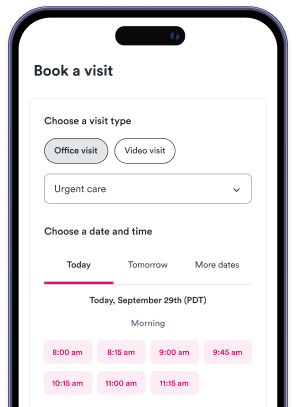

Urgent care near me

The first step in submitting a short term disability claim is by getting a doctor’s note that proves you need time off work for a specific illness, injury, or disability. You can get a doctor’s note from urgent care.

FAQs

What is short term disability insurance?

Short term disability insurance is a type of coverage that provides income replacement for individuals who are unable to work due to a temporary disability, illness, or injury.

How long does short term disability insurance typically provide coverage?

Short term disability insurance typically provides coverage for a period ranging from a few months up to a year.

How is short term disability insurance different from FMLA?

FMLA is an unpaid program that protects your job and health benefits for up to 12 weeks per year, while short term disability insurance provides income replacement during a temporary inability to work.

What are the benefits of short term disability insurance for employers and employees?

For employers, it can attract and retain valued employees. For employees, it provides financial stability during a temporary inability to work and peace of mind to focus on recovery.

What conditions typically qualify for short term disability?

Conditions that qualify can vary, but common ones include illnesses, injuries, surgeries, complications from pregnancy, recovery from childbirth, and other temporary medical conditions that prevent an individual from working.