Key points

- Health insurance helps cover the high cost of healthcare in the US, with over 90% of Americans having a plan.

- Monthly health insurance payments depend on factors such as location, age, and type of plan.

- More than 50% of Americans get health insurance through their employers, while others buy from state and federal marketplaces.

- Health insurance plans are required to cover certain essential services and cannot deny coverage based on medical history or pre-existing conditions.

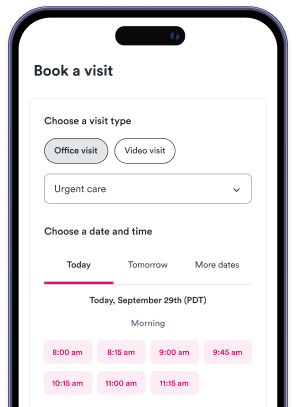

- The Solv app has been created to help individuals understand and track their health insurance, making the complex U.S. healthcare system more accessible and manageable.

It’s no secret that the cost of healthcare in the United States is higher than what most Americans can afford on their own. Health insurance helps shoulder some of the financial burden that comes from being a human who, from time to time, needs medical treatment. However, it’s hard to see how health care coverage benefits you when healthcare policies are filled with dry, technical language that you’d need hours (and gallons of coffee) to decode.

Over 90% of Americans have a health insurance plan to help cover the expense of healthcare, but most people aren’t taught a lot about how insurance really works. Knowing exactly how something works gives you a lot of power, so you can see when you’re getting the best deal–or not. You’re used to making informed decisions about what you buy–everything from your car, to your cell phone, to your meals–why should health insurance be the exception to that rule?

We’ve created this breakdown to help you navigate health insurance in the United States, including where to get it, what it covers (and doesn’t), and how insurance companies process payments.

How does health insurance save you money?

In America, a single hospital visit costs around $20,000. That’s about what you’d pay for a new car (and not a clunker either). Even though you’re probably not planning any upcoming hospital stays, having health insurance can help cut down what you pay on healthcare and save you from being stuck footing the entire bill if you do end up going to the emergency room (though we hope you won’t have to).

When you pay your premium, aka your monthly payment for your insurance coverage, your health insurance provider agrees to help with your medical bills. You may not have health-related expenses every month but, when you do, your coverage will be there to split the bill, as long as you’ve met your deductible (the amount you have to pay out-of-pocket before your insurance starts chipping in).

In 2019, monthly health insurance payments in the U.S. were about $599 per person or $1,715 for a family. What you pay for your premium each month depends on where you live, how old you are, what type of plan you get, if you smoke tobacco, and whether you enroll as an individual or a family. Thanks to the Affordable Care Act (ACA), you can’t be charged more for health insurance because of your gender or pre-existing conditions.

Half of Americans get health insurance through their employer

Over 50% of Americans get health insurance through their employers, according to the U.S. Census Bureau. When you can get insurance through your work, it’s usually cheaper than buying from somewhere else because your employer pays part of your monthly premium. If you’re one of the almost ten million self-employed Americans–or you don’t have access to job-based insurance because you’re a part-time employee or unemployed–you’re stuck finding your own coverage (but we’re here to help!).

You can buy health insurance online from state and federal marketplaces, like HealthCare.gov. You’ll even potentially have lower monthly payments–thanks to federal tax credits–if you meet certain income requirements. If you make too much to qualify for lower monthly premiums, you can also get coverage directly from health insurance companies, private enrollment websites, and in-person agents and brokers. For a breakdown of how to choose who to buy your insurance from, check our post on getting health insurance after open enrollment.

How much of your healthcare costs are covered by insurance?

To figure out how much you’ll pay–and when you’ll have to pay it–we need to take a closer look at how you’re charged for your healthcare.

Let’s use a typical urgent care visit as an example:

- When you go to urgent care, you’ll pay your copay–a flat fee for the visit–up front.

- Copays for urgent care visits are typically between $25 and $75.

- If you haven’t met your deductible yet, you’ll be responsible for the whole bill, not just your copay.

- If you have met your deductible, the clinic will send your insurance company a bill for the appointment, including any tests, x-rays, vaccines, or other services that you got during your visit.

- Your insurance company will pay their part of the bill directly to your doctor.

- After all that, your doctor will send you a bill for the rest.

How much your insurance company pays depends on your coverage. (Not sure what your insurance covers? Our Solv app helps you keep track of that!) Also, if your doctor is in-network, you’ll pay less than if you saw an out-of-network doctor. That’s because doctors that are in your insurance network have agreed to charge lower prices to people with your insurance.

What services should your insurance cover?

The ACA (yes, we’re still talking about it) told insurance companies that there are certain benefits that everybody should have the right to. If you get your insurance from your employer or the healthcare marketplace, it should cover these essential services:

- Outpatient care

- Emergency services

- Hospitalization

- Pregnancy, maternity, and newborn care

- Birth control

- Mental health care

- Substance use disorder services

- Prescription drugs

- Laboratory services

- Chronic disease management

- Preventative and wellness services

- Pediatric services, including oral and vision care

- Services and products needed to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills

To ensure you get the healthcare you need and to protect you from even higher medical costs, these insurance plans are not allowed to:

- Restrict access to a plan based on a patient’s medical history

- Deny coverage for pre-existing conditions

- Deny coverage for any of the essential health benefits outlined above

- Deny coverage renewal to people who are up-to-date on premium payments

- Have unlimited out-of-pocket costs

Where can you buy health coverage?

In the United States, you can get health insurance through:

- A plan offered by your job or your spouse’s job

- Your parents’ plan, if you’re under 26 years old

- A health insurance company’s website

- Your state health insurance marketplaces

- The federal Health Insurance Marketplace (HealthCare.gov)

- Online insurance brokers

- In-person insurance agents

- Government assistance programs, such as Medicare, Medicaid, and CHIP

- The Veterans Administration or TRICARE (for military personnel)

How do insurance payments work?

When your doctor sends a bill to a health insurance company, it will include the entire cost for your visit, minus any payments that you made while you were there (aka your copay). When your insurance company gets the bill, here’s what typically goes down (though you’ll have to double-check with your insurance company to get the specifics):

- Someone will check the bill for accuracy, and see if your plan covers the services on the claim.

- Then, they’ll look at if you’ve paid your deductible or hit your out-of-pocket maximum for the year.

- Once they figure out what they owe, based on your deductible, your coinsurance, and your out-of-pocket maximum, your insurance company will pay your doctor directly.

- They’ll also send you an Explanation of Benefits (EOB) that explains what they paid for and why. This is the statement you get that says, “This is not a bill.”

- After your doctor gets the payment from your insurance, they’ll send you a bill for the rest.

- You pay the doctor. (Before you do this, you should check if the bill that you receive from your doctor matches your EOB. If the bill and EOB don’t match, you may need to talk to your doctor and insurance company to figure out what you owe.)

The U.S. healthcare system is notoriously confusing and expensive. We understand that it’s easy to feel like you’re putting more into your health insurance than you’re getting out of it, but learning about your coverage puts the power back in your hands. That’s why we created the Solv app: so you can understand and track your health insurance in about the time it takes to snap a photo of your insurance card. Download now.

FAQs

Why is health insurance important in the US?

Health insurance is important as it helps cover the high cost of healthcare, which most Americans cannot afford on their own.

What factors affect the cost of health insurance premiums?

The cost of health insurance premiums depends on factors such as your location, age, type of plan, whether you smoke tobacco, and whether you enroll as an individual or a family.

How do most Americans get their health insurance?

Over 50% of Americans get health insurance through their employers. Others buy from state and federal marketplaces, health insurance companies, private enrollment websites, and in-person agents and brokers.

What services are health insurance plans required to cover?

Health insurance plans are required to cover essential services such as outpatient care, emergency services, hospitalization, pregnancy and newborn care, mental health care, and prescription drugs.

Can health insurance plans deny coverage based on medical history or pre-existing conditions?

No, health insurance plans cannot deny coverage based on a patient's medical history or pre-existing conditions.

How does the billing process work with health insurance?

When you visit a healthcare provider, they will send a bill to your insurance company. The insurance company will check the bill for accuracy and see if your plan covers the services on the claim. They will then pay the provider directly and send you an Explanation of Benefits (EOB) that explains what they paid for and why. You will then be responsible for paying the remaining balance to the provider.

What are some places where I can buy health coverage in the United States?

In the United States, you can get health insurance through a plan offered by your job or your spouse's job, your parents' plan if you're under 26 years old, a health insurance company's website, your state health insurance marketplaces, the federal Health Insurance Marketplace (HealthCare.gov), online insurance brokers, in-person insurance agents, and government assistance programs.

What is the Solv app and how can it help me understand my health insurance?

The Solv app is a tool that helps you understand and track your health insurance. It provides information about your coverage and helps you manage your health insurance in an easy and convenient way.