Key points

- A patient received a surprise bill of $517 after a skin cancer removal procedure at an out-of-network facility.

- The patient's insurance was unable to cover the facility costs despite the doctors being in-network.

- The federal government has introduced the "No Surprises Act" to prevent such surprise billing and promote price transparency.

- The patient advises others to scrutinize all insurance paperwork and inquire about unclear charges.

As part of Solv’s ClearPriceTM initiative, our team is highlighting real-life stories about how surprise medical bills have affected people’s lives.

Debby's Story

As Debby opened the mail, her breath caught with surprise: a bill for $517.

Just one month earlier, her husband, age 71, had gotten skin cancer removed from his elbow at a local skin cancer surgery center in the small town where they live. Both Debby and her husband are on Medicare Part C, meaning they are covered through a private insurer.

Squinting at the “explanation of benefits” (EOB) form in the mail, Debby was confused — and soon grew frustrated. Her husband had used this particular dermatology practice before without having any issues; she had specifically done research to ensure that the specialist was “in-network,” or covered by their insurance provider.

Debby had already paid a copay upfront, before her husband had the procedure, back in January. She didn’t understand why she’d receive such a hefty bill after the fact.

She reread the form closely, this time to notice language specifying that the dermatology group had doctors who were in-network. But the actual facility where they operated — the only facility used exclusively by the specialist that her husband needed — was out of network.

“Nowhere on the insurance company's website can you search in-network/out of network status of the surgical facility of this practice,” said Debby.

“I’m thinking: ‘How is it possible that they can do that?’” she said. “That just seemed like such a rip.”

The situation that Debby and her husband are facing is all too common. Nearly one in five patients who go to the emergency room, have an elective surgery or give birth in a hospital receive surprise bills — when a patient is billed for work from an out-of-network provider or facility — according to research cited by the Centers for Medicare and Medicaid Services.

Just this year, the federal government put new rules in place to prevent surprise billing, as well as “balance billing” (when healthcare providers bill a patient for the difference between the amount that they charge and what the insurance company is willing to pay). “The No Surprises Act” aims to create greater price transparency so that Americans know what they’re signing up for when they show up to the doctor’s office — and don’t have to make impossible choices between staying financially afloat or getting the healthcare they need.

The law also requires providers and plans to notify consumers of their surprise medical bill protections, according to the Kaiser Family Foundation. Even so, some hospitals and providers may evade regulations or fail to comply.

Debby, for one, wasn’t going to sit still until she got to the bottom of her situation. She called her insurance company. When the company affirmed that the center itself where her husband was treated was out of network, she wanted to know: could these doctors have performed the surgery anywhere else? Had she known this information upfront, would she have had any other in-network options? Debby called her dermatologist’s office to find out.

The answer? No. Her husband’s dermatologist only operated at their center, she was told.

Debby was angry. She felt this was fundamentally unfair. “They have got you, literally,” she said. “This town is very small. They’re the only dermatologist around.”

Patients like her don’t have alternatives; they also don’t have time to waste. Her husband’s biopsy in December had made it clear that he needed this surgery as soon as possible — plus, he had already had skin cancer once before.

“I guess I feel like they stuck it to us,” Debby said. “They have you between a rock and a hard place.”

Price transparency is crucial so that patients like Debby can have all the information they need — and understand what they’re signing up for. After all, nobody would willingly buy a house or car without knowing the cost of the down payment.

What advice does she have for others who find themselves in similar situations? “Scrutinize every piece of paper you get from your insurance company,” she said, adding that people should examine every line item and call to inquire where a charge comes from when something looks amiss. “Lots of people just shove it into a drawer.”

Patients like Debby shouldn’t have to jump through hoops and make a slew of phone calls just to receive the bare minimum of what they deserve: accurate information. But in the current state, it is clear that the American healthcare insurance system is broken.

Debby, meanwhile, isn’t going down without a fight. She filed an appeal, and is waiting to hear back about whether the claim might be adjusted.

“I thought I knew everything to look for when trying to decide on an insurance plan… then we got hit with this surprise thing,” she says. “Until you have this experience, you don’t think to ask the question.”

Actual user story. All pricing details are reported by the individual. Names may have been changed to protect anonymity. If you’d like to share your experience dealing with a surprise medical bill, write to us at clearprices@solv.com to tell us your story.

Five tips for choosing to self-pay for healthcare

Melissa's not alone in her frustration and confusion around our healthcare system, of course. When considering self-pay, there is a lot to keep track of. Here's a quick break down the self-pay process one step at a time.

- Assess the situation. What kind of medical care do you need? Is this a routine or big-ticket item? What month of the year is it, and how close are you to hitting your deductible?

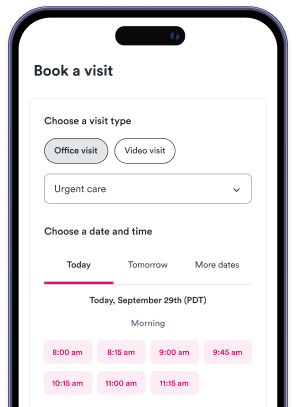

- Do your research and shop around to compare prices. First, you should try to figure out how much the procedure costs in-network. You can use an insurer’s online tools or call the company (keeping in mind that final costs fluctuate, and may not exactly match the quote). Costs often vary widely by provider and region of the country, so this step is extra important.

- Directly ask providers what their cash prices are. Some providers may not make it easy to find estimated prices, so be persistent and remember that you’re entitled to this information: as of 2021, hospitals are required to provide patients with the cash price information during a visit even if the patient has insurance.

- If the insurer’s cost is higher, ask providers for a cash discount. You may be surprised at how many providers will do this when they ask. That’s key: patients often have to pose the question, according to KTVB. However, some providers committed to transparency make this information easily accessible upfront, or advertise discounts widely. Other hospitals feature price estimate calculators on their websites.

- If you decide to go with cash prices out of network, compare local competitors. Once patients aren’t limited to providers in-network, they can choose between a wider range of doctors.

Learn more about Solv’s commitment to cracking open the mystery of healthcare pricing through our Solv ClearPrice Pledge. Try our Solv ClearPrice calculator to find the cost of care for services in your zip code, or take the quiz to find out if you should be asking for the ClearPrice of care in advance of care.

FAQs

What is Solv's ClearPrice initiative?

Solv's ClearPrice initiative is an effort to highlight real-life stories about how surprise medical bills have affected people's lives. The aim is to increase transparency in healthcare pricing.

What is a surprise medical bill?

A surprise medical bill is a bill for work from an out-of-network provider or facility. This often happens when a patient goes to the emergency room, has an elective surgery, or gives birth in a hospital.

What is the "No Surprises Act"?

The "No Surprises Act" is a law put in place by the federal government to prevent surprise billing and balance billing, which is when healthcare providers bill a patient for the difference between the amount they charge and what the insurance company is willing to pay. The act aims to create greater price transparency so that Americans know what they're signing up for when they go to the doctor's office.

What are some tips for dealing with surprise medical bills?

To deal with surprise medical bills, it's recommended to scrutinize every piece of paper received from your insurance company, examine every line item, and call to inquire where a charge comes from when something looks amiss.

How can patients avoid surprise medical bills?

To avoid surprise medical bills, patients can research and compare prices, ask providers for their cash prices, ask for a cash discount if the insurer’s cost is higher, and compare local competitors if choosing to go with cash prices out of network.

What is balance billing?

Balance billing is when healthcare providers bill a patient for the difference between the amount that they charge and what the insurance company is willing to pay.

What is the role of insurance in surprise medical bills?

Insurance plays a significant role in surprise medical bills. Sometimes, even if a doctor is in-network, the facility where they operate may be out of network, leading to unexpected charges. It's important to verify both the doctor and the facility's network status with your insurance provider.

What is the ClearPrice Pledge?

The ClearPrice Pledge is Solv's commitment to cracking open the mystery of healthcare pricing. They offer a ClearPrice calculator to find the cost of care for services in your zip code, and encourage patients to ask for the ClearPrice of care in advance.